Market Commentary: A New Normal and The Repricing of Stocks

A New Normal and the Repricing of Stocks

Barton W. Weisenfluh, CFP®

March 10, 2020

I have loved the stars too fondly to be fearful of the night.

-Galileo Galilei

In only a few short weeks, the stock market has made an unprecedented price adjustment with the major stock indexes falling close to -20% (Source: WSJ). The 24-hour news cycle and social media have made it impossible to escape the wave of stories on the Coronavirus. In addition, the most recent sell off (as of March 9th) highlighted the tinderbox of anxiety we are currently in. Specifically, over the weekend Russia and Saudi Arabia entered into a price war on oil prices causing crude prices to plummet the most since the 1991 Gulf War – this price shock was on top of an already anticipated slowdown in energy demand for 2020. This news in turn brought fresh concerns about the credit markets freezing over and the risks associated with highly leveraged energy companies. Uncertainty reins throughout the world of risk assets and will remain in the form of price volatility until we receive greater clarity on market uncertainties.

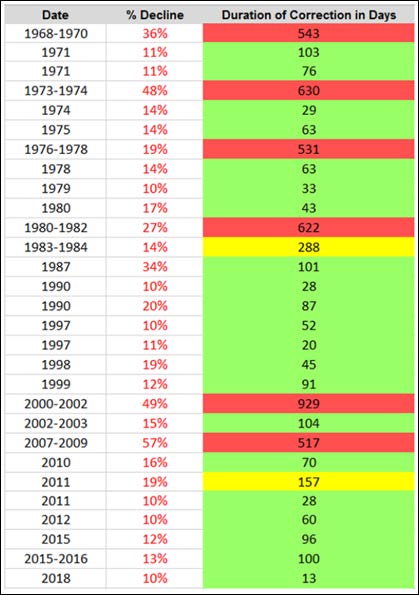

With a nod to Sir John Templeton (below chart & quote), the stock market has consistently had a history of market crashes and volatility with eventual recoveries and/or bounce backs. Although each market downdraft has its own specific characteristics, fear, by far, is the most common and hardest to manage. At Starboard we are focused on continuing our ownership of high-quality investments for the long run – it is what prudent investors do and has paid off time after time. For the majority of families we advise, cash and bonds have specifically been set aside to help ride out a prolonged storm and in some cases take advantage of the reduced prices now available for excellent global franchises. The passage of time is almost always the ally to investors; however, this is easily forgotten in the face of financial trauma. Looking back at history can sometimes soften this perspective particularly, as is the case now, when no end is in sight.

Starboard Advisors | A division of Kelleher Financial Advisors, LLC

Looking back less than three months, we think it is important to note that the year began on mostly unleveraged economic sure footing and interest rates will remain low for the foreseeable future. Fiscal stimulus by our government will be required and the public’s realignment of life with the Coronavirus will need to make daily progressions until a level of certainty grounds market fears. Until then, we believe volatility will carry the day and are advising families to find assurance in their cash, bond and hard asset holdings.

A history of stock market declines: YahooFinance

In the coming weeks and months as the markets and economy evolve, we will continue to be in contact with the families we represent and available anytime for direct communication. As we like to say in the hallways at Starboard, our team will be “On station.”

My very best regards,

Barton W. Weisenfluh, CFP ®

Founder & President