Our Investment Committee represents a diverse cross-section of backgrounds, opinions, and information sources to drive our strategic investment management recommendations to the families we serve.

Committee Support

Starboard utilizes a number of external research oriented professionals as needed to complement and further support our committee.

- Customize family portfolios by determining investment objectives, liquidity requirements and risk tolerance for each silo of assets

- Provide access to quality investment solutions, both actively and passively managed in a broad range of investment classes globally

- Integrate existing holdings, including real estate, private equity and other non-liquid investments into portfolios

- Provide a single summary of performance, asset allocation, and liquidity for ALL investments

How We Operate

Starboard creates customized plans tailored to each family with specific objectives, return expectations, liquidity parameters, tax constraints and risk tolerances. We are also true investment fiduciaries, which means our advice is objective, agnostic, and flexible with no preference for active versus passive/index investments or specific vehicles. We seek out unique opportunities in all asset classes by carefully selecting, analyzing and monitoring objective third-party money managers in a variety of investment vehicles.

Starboard does not sell conflict of interest prone “proprietary” investment products and we are paid only by our clients, no one else. There are no hidden fees or commissions. We always offer total transparency on investment decisions, contracts, processes, and results, and all of our asset management oversight comes with single point access of consolidate reporting online, on our phone or in your mailbox.

Starboard’s Investment Workflow

Starboard’s investment management process is based on a single premise: give our clients our “best thinking” from some of the brightest minds we know.

Discovery & Intent

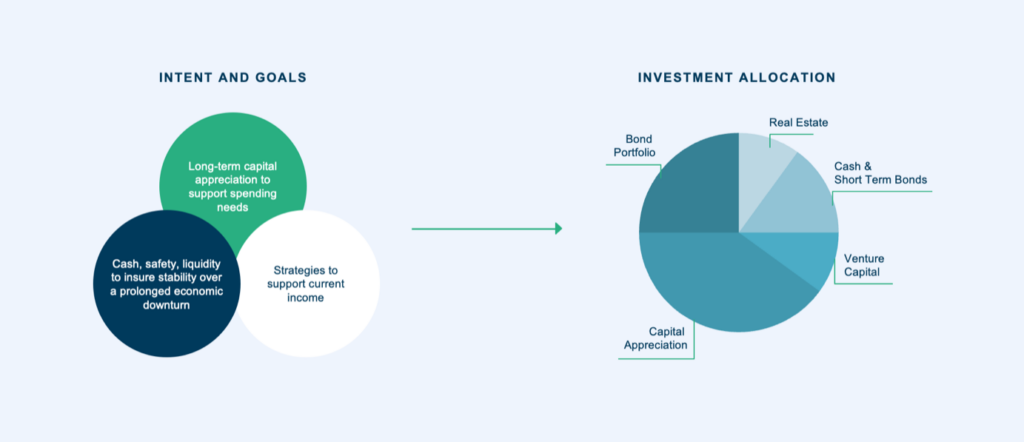

Interviewing families one-on-one over multiple interactions allows us to draw out investment & planning “intent” for the long-term with an ongoing goal to align those ideals with long-term investments and cashflow needs.

Purpose Based Strategic Asset Allocation

Starboard focuses on purposed based investment allocations for the specific needs of its clients. Our goal is to align personal profiles with targeted investment outcomes with less risk.

Specific Tactical Asset Allocation

Our investment professionals and investment team seek out the best available strategies and investment vehicles to fill their designated risk allocations. We have no limit on platforms, nor are we bound by internal product.

Transparent Monitoring & Reporting

Family investments are continuously monitored by our internal Investment Committee and investment professionals. We employ a number of third party systems to present and compare returns net of any expenses.

Resources & Insights

-

Fast Forward 2025: Family Business Summit

Exploring The Family Business And Success With Future Generations About the Event Whitepenny, Starboard Advisors, and Archer & Greiner are…

-

Starboard Commentary, March 2025

An Update from Starboard Advisors In light of the recent market volatility, we thought it would be helpful to send…